Updated: December 26, 2024

If your brand relies on Mexico for distribution, it’s time to think strategically. Mexico has recently introduced new tariffs on imported textiles and restricted the benefits of its IMMEX program. These changes will significantly impact apparel brands that import into Mexico and use it as a fulfillment hub to ship into the U.S. With tariffs as high as 35% on finished goods, many brands will need to immediately reevaluate their supply chain to avoid these rising costs.

The latest TL;DR as of December 26, 2024:

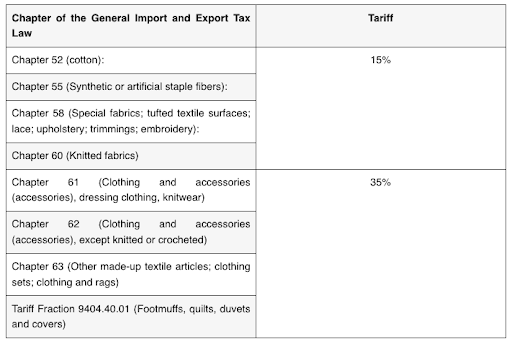

- Mexico imposed tariffs of up to 35% on finished apparel imports and 15% on textile imports, effective until April 2026.

- The IMMEX program now prohibits temporary importation of many apparel items, creating challenges for brands relying on Mexico as a distribution hub.

- Solutions include shifting fulfillment to U.S. domestic facilities or Canadian 3PLs, leveraging Section 321 from Canada for duty-free cross-border shipments

- GoBolt offers expertise with U.S. and Canadian apparel fulfillment, including Section 321 optimization, to help brands navigate these changes efficiently.

Shifting fulfillment operations to the U.S. or Canada and leveraging duty-free options like Section 321 could help you stay competitive.

Let’s explore what these changes mean and how to adapt.

What Changed in Mexico's Trade Policies?

Mexico has implemented significant trade policy changes, translating to higher costs and limited flexibility for apparel brands using Mexico as a distribution hub.

These changes include:

- Higher Tariffs on Textiles:

- A 35% tariff now applies to finished apparel imports.

- A 15% tariff applies to certain textile inputs like fabrics.

- Restrictions on IMMEX Program:

- The IMMEX program, which allowed temporary duty-free imports for processing and re-export, now prohibits temporary importation of many apparel items, including finished goods.

- The IMMEX program, which allowed temporary duty-free imports for processing and re-export, now prohibits temporary importation of many apparel items, including finished goods.

- Timeline:

- These changes are effective from December 19th 2024 to April 2026, with the possibility of further extensions or adjustments.

- These changes are effective from December 19th 2024 to April 2026, with the possibility of further extensions or adjustments.

What This Means for Apparel Brands

These changes create immediate challenges for apparel brands. Brands must now adapt quickly to mitigate these impacts while maintaining efficient operations.

- Increased Costs: Importing finished goods into Mexico is now significantly more expensive, eroding profit margins.

- Operational Disruptions: Brands relying on IMMEX benefits must revamp their supply chain to comply with the new restrictions.

- Reduced Competitiveness: Higher costs may force price increases, making products less attractive to U.S. consumers.

Solutions for Apparel Brands to Avoid These Tariffs

1. Shift Fulfillment to the U.S. or Canada

- Moving fulfillment operations to the U.S. eliminates tariff complications. Domestic fulfillment centers offer faster delivery to U.S. customers and avoids the complexities of cross-border logistics.

- Canada is another option, especially when leveraging Section 321 (see below). This may only be a short term fix as further changes to Section 321 may occur in 2025.

2. Leverage Section 321 from Canada

- What is Section 321? It’s a U.S. trade provision that allows duty-free shipments of goods valued under $800 from Canada to the U.S.

- Why it Matters: Apparel brands can fulfill orders from Canadian warehouses and ship directly to U.S. customers without incurring duties.

- How GoBolt Helps: GoBolt’s Canadian facilities are optimized for Section 321, enabling fast, cost-effective shipping.

3. Reassess Sourcing and Manufacturing

- Import raw materials (e.g., fabrics) instead of finished goods to Mexico for assembly, which may still qualify under IMMEX.

- Alternatively, shift production to other low-cost regions with favorable trade agreements with Mexico, such as Central America or Southeast Asia.

4. Diversify Your Distribution Network

- Diversify your distribution networks by splitting operations between U.S. and Canadian fulfillment centers. This allows you to serve different markets cost-effectively and adapt to evolving trade policies.

GoBolt’s Role in Supporting Apparel Brands

GoBolt is here to help apparel brands navigate these challenges and turn them into opportunities.

Here’s how we do it:

- Canadian and U.S. Warehousing: Strategically located facilities to serve both markets efficiently.

- Apparel Expertise: GoBolt supports many apparel brands with US and Canadian cross-border fulfillment. From inventory and SKU management to wholesale and unboxing expertise, GoBolt has apparel brands covered.

- Sustainable Last Mile Delivery: Fast, eco-friendly delivery options to meet customer expectations.

See how Solgaard worked with GoBolt to implement a scalable logistics strategy using our Section 321 expertise, daily direct injection across the border, and order orchestration to streamline fulfillment from Canada to the US. Read more here.

Final Thoughts

Mexico’s new tariffs and IMMEX restrictions may pose challenges, but they also present an opportunity for apparel brands to optimize their operations. By partnering with a 3PL like GoBolt, you can reduce costs, improve delivery speeds, and ensure compliance with evolving trade laws.

Don’t let changing policies disrupt your business. Contact GoBolt today to learn how we can help you adapt and scale.