Latest Update: August 7, 2025

Importing goods into the United States can be a complex and costly process. Duties, taxes, and stringent importation regulations can quickly inflate shipping costs for both brands and shoppers. For years, Section 321 offered a valuable loophole, allowing low-value shipments valued at $800 or less to enter the U.S. free of duties and taxes under the de minimis provision.

On July 30, the U.S. government announced it will be suspending the de minimis exemption for all countries starting August 29. That means all low-value commercial shipments under $800 will now face duties, and brands relying on international fulfillment may be in for a surprise this peak season.

The timing couldn’t be tougher. The complexity and cost of cross-border fulfillment are about to spike.

While these change are still subject to potential revisions, brands must prepare for a shift that could disrupt established fulfillment strategies.

In this article, we’ll break down what these changes mean for Section 321 fulfillment, U.S. customs clearance, and how your business can adapt to continue benefiting from streamlined cross-border shipping processes.

Whether you’re a Canadian merchant leveraging Section 321 to reach U.S. shoppers or navigating customs clearance for e-commerce, staying informed is critical.

Previous Changes to Section 321

What is Section 321?

Section 321 is a law put in place by the US Custom and Borders Protection that allows shipments valued under $800 to enter the U.S. duty-free.

Historically, this exemption has been especially valuable for ecommerce brands relying on Section 321 fulfillment to streamline shipping and reduce costs associated with U.S. customs clearance.

However, as of May 2, 2025, the U.S. is eliminating the de minimis exemption for goods originating from China and Hong Kong.

This restriction is expected to expand beyond China and Hong Kong. According to the U.S. Commerce Secretary, once the necessary systems are in place, the de minimis exemption will be phased out for all other countries, though no official timeline has been confirmed.

Previously, the $800 threshold, raised from $200 in earlier reforms, allowed brands to ship products into the U.S. without incurring duties or taxes. For example, if you sell high-quality apparel and your best-selling jacket is priced at $375, Section 321 enabled you to ship into the U.S. without hefty import fees.

Now, with the removal of the de minimis threshold, companies will need to reconsider their fulfillment strategies to avoid additional expenses and potential delays at U.S. customs.

Understanding how these changes impact Section 321 customs clearance and entry processes will be crucial for maintaining cost-effective shipping practices moving forward.

How does a business claim Section 321?

Utilizing Section 321 for shipping doesn’t require much extra legwork on your end. Your shipments should enter into the United States duty-free if the attached invoices list the value of your product at under $800. It’s that easy.

Pro tip: Make sure the product value is clear on attached invoices. The clearer it is, the easier it is for the product to clear customs quickly. If you work with a third party logistics provider, like GoBolt, the documents, manifestation, and clearance is all handled for you. This means no additional backend work for you.

Benefits of Section 321 for brands and retailers

It’s clear that there are some major benefits of Section 321, especially for brands located outside of the United States with products valued under the de minimis value of $800.

Let’s break down what some of the benefits of Section 321 fulfillment are.

Market expansion opportunities

If your business is located in Canada, you’re selling to around 37 million people. When you enter the US market, you’re reaching an audience ten times that size! However, the affordability of shipping may have been a deterrent to expanding.

With Section 321, you’ll see some major savings on shipping costs. Given anything you import will be duty-free, it makes cross-border shipping way more affordable.

Cost savings and enhanced shopper experience

Section 321 enables duty-free imports, resulting in substantial savings on shipping costs, making it more economical to reach U.S. consumers. And while this benefit only applies to you if you have already been shipping across borders, it’s still important to flag. Given how high the cost of duties can be, your shoppers may have been seeing higher shipping rates at checkout. With Section 321 in place, and you are able to save on duty, you can pass those savings onto your shoppers.

And more affordable shipping makes potential buyers even more likely to hit that “add to cart” button.

Faster, more efficient shipping processes

Delivery times are a huge factor for shoppers when placing an order. More than 50% of shoppers stated that the speed of delivery directly influences their purchasing decisions.

Luckily, Section 321 makes it easier for packages to cross the boarder quicker. Simplified customs procedures under Section 321 streamline border clearance, leading to quicker transit times for shipments under $800.

And, faster delivery times enhance shopper satisfaction and contribute to more efficient order fulfillment processes.

Still evaluating your options? See how GoBolt helped this brand with their expansion into US domestic fulfillment.

What are the restrictions of using Section 321 fulfillment?

Unfortunately, this isn’t a law that blindly covers everything – there are some exceptions.

1. Non-compliant goods

This shouldn’t come as a surprise to most seasoned brands who ship internationally. Every country has different rules on what goods are (and are not) allowed to be shipped within their borders.

Some of the non-compliant goods under Section 321 include:

-

- Goods that need inspection as a condition of release, even if they are under the $800 value.

-

- Merchandise subject to Anti-Dumping Duty (ADD) or Countervailing Duty (CVD).

-

- Non-medical devices that emit radiation.

-

- Goods that are specifically regulated by the Food and Drug Administration (FDA), Food Safety Inspection Service (FSIS), Consumer Product Safety Commission (CPSA0, United States Department of Agriculture (USDA), and National Highway Transport and Safety Administration (NHTSA).

-

- Cigarettes, cigars, e-cigarettes, or alcoholic beverages.

- Cigarettes, cigars, e-cigarettes, or alcoholic beverages.

2. Restrictions on imports from china

After this article, you’ll know Section 321 like the back of your hand, but do you know about Section 301?

Section 301, also known as 301 China, is an increased tariff put on goods imported from China into the U.S. For the time being, Section 321 actually overrides Section 301, but it’s an important restriction to be aware of if you regularly import goods from China, as things can change.

3. Claims can only happen once a day

This is an important one to flag, as you can only make one tax-exempt import per day. If you make more than one daily claim, you may face serious penalties – $5,000 in penalties in some cases. Make sure your 3PL provider isn’t claiming numerous times per day.

What are the benefits of managing Section 321 shipments with a 3PL partner

Streamlined documentation and clearance

-

- By partnering with an end-to-end 3PL provider experience in cross-border shipments, brands can benefit from a cost-effective and swift shipping solution into the US.

-

- A 3PL can efficiently manage the documentation, manifestation, and clearance of eligible shipments, alleviating the burden from brands.

- A 3PL can efficiently manage the documentation, manifestation, and clearance of eligible shipments, alleviating the burden from brands.

Simplified process

-

- Without a 3PL partner, brands must undertake various steps such as picking, packing, and preparing all necessary documents for Section 321 shipments.

-

- They also need to coordinate shipping from the origin to the final destination, adding complexity to the process.

- They also need to coordinate shipping from the origin to the final destination, adding complexity to the process.

Centralized management

-

- With a 3PL handling all Section 321 shipments, brands establish a single point of contact to ensure seamless processing.

-

- Outsourcing logistics allows brands to focus on their core competency of providing high-quality products, rather than navigating shipping intricacies internally or through multiple partners.

- Outsourcing logistics allows brands to focus on their core competency of providing high-quality products, rather than navigating shipping intricacies internally or through multiple partners.

Risk mitigation

-

- Internal handling or multiple partners for cross-border shipments can increase the risk of complications, such as delays due to non-compliant goods.

-

- A strong 3PL partnership mitigates these risks, ensuring smooth transit and compliance throughout the shipping process.

What Are the Latest Changes to Section 321?

May 12, 2025

The US and China agreed to a 90-day pause on the 145% tariffs. During this time, the US will lower its 125% tariff on Chinese goods to 10%, but a separate 20% tariff related to the fentanyl crisis will stay in place. There were no updates to the de minimis rules in this latest announcement.

May 2, 2025

On May 2, 2025, the U.S. officially sunset the de minimis exemption for goods originating from China and Hong Kong. This policy change, initiated under President Donald Trump’s administration, targeted low-value imports from these countries.

April 2, 2025

Here are the key updates concerning Section 321 and the de minimis following the latest announcement from the U.S. government regarding cross-border shipments.

Key Updates:

- De Minimis Changes: As of May 2, 2025, De Minimis (Section 321) will no longer apply to goods originating from China and Hong Kong.

- Future Restrictions: The U.S. Commerce Secretary has stated that once their systems are ready, this restriction will expand to all other countries, though no official timeline has been confirmed.

While these changes are set, the situation remains fluid. It’s possible that affected countries may respond with their own trade measures, leading to further shifts in policy.

March 3, 2025

On March 2, 2025, an amendment was issued by the White House to clarify that duty-free de minimis treatment remains available for eligible goods. In simple terms, this means that, at this time, Section 321 is still operational. This allows for the duty-free crossing of qualifying shipments with a fair retail value not exceeding $800, provided they meet all other eligibility criteria.

To note: The Executive Order specifically references only Canadian and Mexican-origin products as eligible to clear under Section 321. As a result, China-origin products no longer qualify for duty-free entry under Section 321.

February 27, 2025

February 26, 2025

Today, U.S. President Donald Trump said that he will pause the Tariffs going into effect until April.

Is Section 321 going away?

February 25, 2025

U.S. President Donald Trump has said he will move ahead with a 25% tariff on most imports from Canada and Mexico starting next week, as early as March 4. It is still unknown whether Section 321 will go away completely or if the tariffs will be on Canadian and Mexican products only.

February 7, 2025

Suspension of Section 321 Delayed

The White House announced a potential change to the Section 321 de minimis exemption, which allows shipments under $800 to enter the U.S. duty-free. While this exemption remains in place for now, the government is working on a system to apply duties to certain shipments from China.

February 5, 2025

Section 321 Suspended

On February 1, 2025, President Trump issued an executive order that included a provision to halt the Section 321 customs de minimis entry process starting February 4, 2025.

January 21, 2025

Changes Propsed to Section 321

The U.S. Customs and Border Protection (CBP) has proposed changes to Section 321, which could affect how brands ship to the U.S. Currently, Section 321 lets goods worth $800 or less enter the U.S. without duties or tariffs.

The proposed new rule aims to remove goods subject to tariffs under Section 232, Section 201, and Section 301 from being eligible for duty-free entry under the de minimis exemption.

Currently, products under absolute or tariff-rate quotas — whether those quotas are open or closed — and items subject to antidumping and countervailing duties, are already excluded from de minimis eligibility. However, goods affected by Section 201, 232, and 301 tariffs can still use the exemption, which the new rule seeks to change.

Brands must stay current to ensure their shipping practices follow the new rules.

How Brands Are Adjusting Fulfillment Strategies Amid New Tariffs and Section 321 Changes

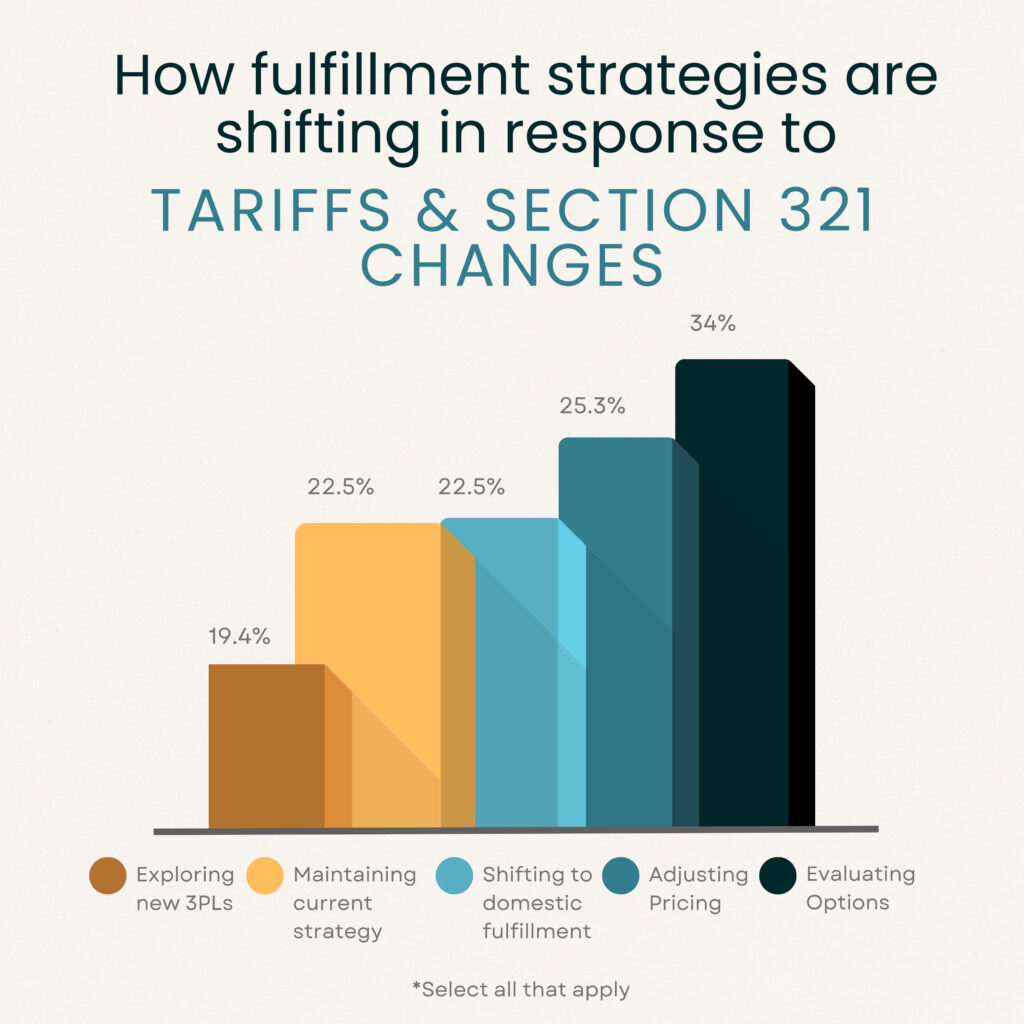

With the recent tariff announcements and potential shifts in Section 321 regulations, brands are in a state of flux and weighing their options carefully. We recently surveyed brands to ask how they are navigating the changes, and the results reveal a clear trend: while some are making decisive moves, many are still evaluating their next steps.

Survey Key Takeaways:

(*select all that apply option)

📌 34% are still evaluating their options. The uncertainty is real.

📌 25.3% are continuing with cross-border shipping but adjusting pricing to offset costs.

📌 22.5% plan to maintain their current fulfillment strategy – stability matters.

📌 22.5% are shifting more inventory to U.S. and Canadian warehouses for domestic fulfillment.

📌 19.4% are exploring new 3PL or warehousing options to minimize cross-border shipments.

Key Takeaways: Section 321 simplifies cross-border commerce

Section 321, a regulation by the US Customs and Border Protection, revolutionizes international shipping by exempting low-value shipments under $800 from duties, unlocking cost savings and market access for brands.

This law not only reduces shipping expenses but also enhances the shopping experience for customers. Leveraging a trusted 3PL partner further streamlines Section 321, ensuring seamless transit and risk mitigation. In essence, Section 321 serves as a catalyst for growth, empowering brands to thrive in the global marketplace.